Press Release

|December 16,2024Blockbuster new private home sales amid unprecedented launches in November; monthly transactions hit the highest since March 2013

Share this article:

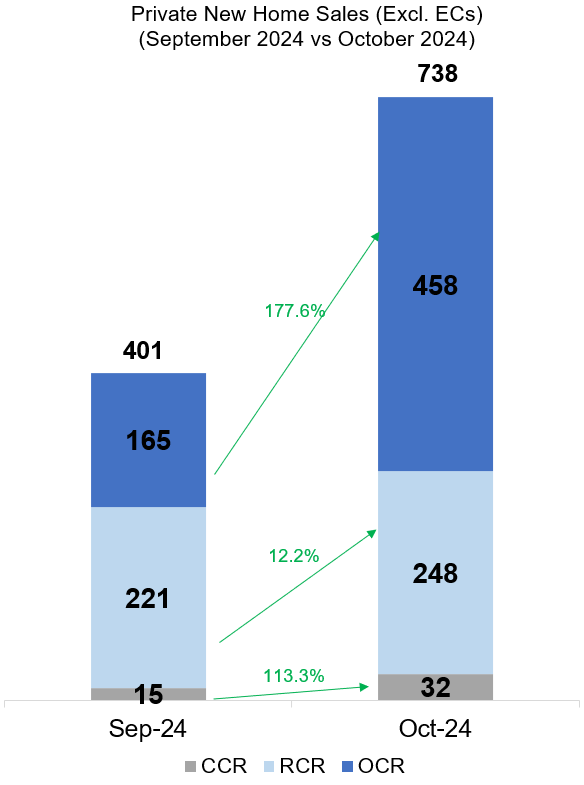

Monthly developers' sales hit more than a decade's high in November, as a deluge of new launches drove a surge in transactions. There were 2,557 new private homes sold (ex. executive condos) in November, marking the highest number of new units sold in a single month since 2,793 units were shifted in March 2013. November's sales were more than three times that of October where 738 units were sold, and on a year-on-year basis, developers' sales rose by 226% from the 784 units transacted in November 2023.

The spike in sales was due to the unprecedented supply of new launches during the month. There were six back-to-back project launches (incl. an EC project) which offered a total of 3,551 units. The five new private condo launches in November - Union Square Residences, The Collective at One Sophia, Chuan Park, Nava Grove, and Emerald of Katong - collectively shifted 2,106 units, accounting for 82% of the month's new home sales. Meanwhile, the other new project, Novo Place EC sold 289 units in November.

Source: PropNex Research, URA (16 December 2024)

The Rest of Central Region (RCR) led sales in November, with 1,569 units transacted - reflecting a record high monthly sales for this sub-market. Emerald of Katong was the star performer, moving 840 new units at a median price of $2,627 psf, while Nava Grove sold 382 units at a median price of $2,445 psf. The Continuum and new launch project, Union Square Residences also propped up RCR's sales, with 131 and 101 units sold, respectively.

This was followed by the Outside Central Region (OCR) where developers sold 890 new units in November, nearly double of the 458 units transacted in the previous month. Chuan Park was the top-seller in the OCR by a stretch, transacting 721 units at a median price of $2,586 psf, which is a benchmark launch price for an OCR project. Chuan Park made up 81% of OCR's developers' sales in the month. The next best-selling OCR project was Hillock Green which moved 45 units at a median price of $2,278 psf.

Meanwhile, monthly sales in the Core Central Region (CCR) rose to a one year high in November at 98 units, thanks to The Collective at One Sophia, which shifted 62 units at a median price of $2,732 psf during its preview sale. The project will be officially launched in January. Meanwhile, the second top-selling CCR project in November was One Bernam which transacted 15 units at a median price of $2,691 psf.

Collectively, new private home sales in October and November came in at 3,295 units - outperforming the transactions in the first nine months of 2024, where 3,049 new units (ex. EC) sold. Overall, developers sold 6,344 new homes in the first 11 months of the year, on track to beating 2023's sales, which had been the lowest in 15 years at 6,421 units (ex. EC).

Over in the EC segment, sales jumped to 334 units in November from 28 units in October, on the back of a new launch, Novo Place EC that sold 289 units at a median price of $1,654 psf. PropNex expects transactions at Novo Place to pick up pace, when the sales booking for second-timer buyers starts later today (16 Dec).

In November, developers launched 2,871 new units (ex. EC) for sale, up by nearly 438% from the 534 units that were put on the market in October. Separately, 504 new EC units were placed for sale by developers in November.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"The blockbuster developers' sales in November were mainly driven by the new launches which made up some 82% of the 2,557 units sold in the month. This is the highest monthly sales tally since March 2013, and certainly in 2024, November's performance will help to shore up the year's new home sales which had been tepid for most part.

November's sales may be eye-catching, but one swallow does not make a summer, and such an impressive performance may not necessarily be repeated again in the near future, because it came off the back of an unprecedented number of new units offered in the month. In addition, favourable market conditions - such as the moderation in interest rates, improving economic outlook, and pent-up demand from almost a year of limited major new launches - also helped.

In our view, November's robust sales have to be seen in context and they do not automatically imply that an unfettered resurgence is upon the private housing market. Buyers, by and large, remain discerning and continue to take a long-term view of their property purchase. We note that projects that are centrally-located with a higher entry price had more measured take-up rates in November.

Meanwhile, the launches that have done well - Chuan Park, Emerald of Katong, and Nava Grove - have attracted buyers, either due to their superior project attributes, or a lack of fresh supply in that locale, and/or pricing that sat within their housing budget, which could hover at anything below $2.5 million these days. Based on caveats lodged, the majority of units transacted at Chuan Park, Emerald of Katong, and Nava Grove in November were priced at below $2.5 million, at 67.4%, 59%, and 71.2%, respectively (see Table 1).

Table 1: Proportion of units sold by price range in November 2024

Price Range | CHUAN PARK (721 units sold) | EMERALD OF KATONG (840 units sold) | NAVA GROVE (382 units sold) |

$1 mil to < $1.5 mil | 0.0% | 9.0% | 8.1% |

$1.5 mil to < $2 mil | 43.0% | 34.3% | 43.2% |

$2 mil to < $2.5 mil | 24.4% | 15.7% | 19.9% |

$2.5 mil to < $3 mil | 20.9% | 21.4% | 20.4% |

$3 mil to < $3.5 mil | 8.5% | 15.2% | 2.1% |

$3.5 mil to < $4 mil | 2.6% | 3.5% | 2.9% |

$4 mil to < $4.5 mil | 0.6% | 0.8% | 3.4% |

Total | 100.0% | 100.0% | 100.0% |

Despite the spike in sales, the proportion of non-landed private new homes purchased by foreigners (non-PRs) continued to be small, making up just 1% (or 25 transactions) of the total in November. Singaporean buyers and Singapore PRs accounted for 92% and 7% of the sales, respectively.

Given the lack of new project launches in December, we expect developers' sales to fall significantly from that of November. For the full-year 2024, we project that new home sales could range from 6,500 to 7,000 units (ex. EC). In January 2025, the new launches that may be first off the blocks are the 777-unit The Orie in Lorong 1 Toa Payoh (near the Braddell MRT station), and the 113-unit Bagnall Haus which is next to the future Sungei Bedok MRT interchange station. In 2025, we forecast that developers' sales could potentially come in at 8,000 to 9,000 units (ex. EC)."

Table 2: Top-Selling Private Residential Projects (ex. EC) in November 2024

S/N | Project | Region | Units sold in Nov 2024 | Median price in Nov 2024 ($PSF) |

1 | EMERALD OF KATONG | RCR | 840 | $2,627 |

2 | CHUAN PARK | OCR | 721 | $2,586 |

3 | NAVA GROVE | RCR | 382 | $2,445 |

4 | THE CONTINUUM | RCR | 131 | $2,879 |

5 | UNION SQUARE RESIDENCES | RCR | 101 | $3,166 |

6 | THE COLLECTIVE AT ONE SOPHIA | CCR | 62 | $2,732 |

7 | TEMBUSU GRAND | RCR | 53 | $2,348 |

8 | HILLOCK GREEN | OCR | 45 | $2,278 |

9 | GRAND DUNMAN | RCR | 19 | $2,618 |

10 | SORA | OCR | 16 | $2,226 |